Navigating the complexities of securing affordable bail bonds can present significant challenges for families in distress. An understanding of your financial landscape is paramount, as it sets the stage for determining feasible options.

Additionally, researching reputable bail bond companies and comparing their rates can uncover potential savings. However, the process does not end there; the nuances of payment plans and the value of legal counsel can greatly influence outcomes.

As you consider these factors, you may wonder: what specific strategies can ensure you make the most informed decisions during such critical times?

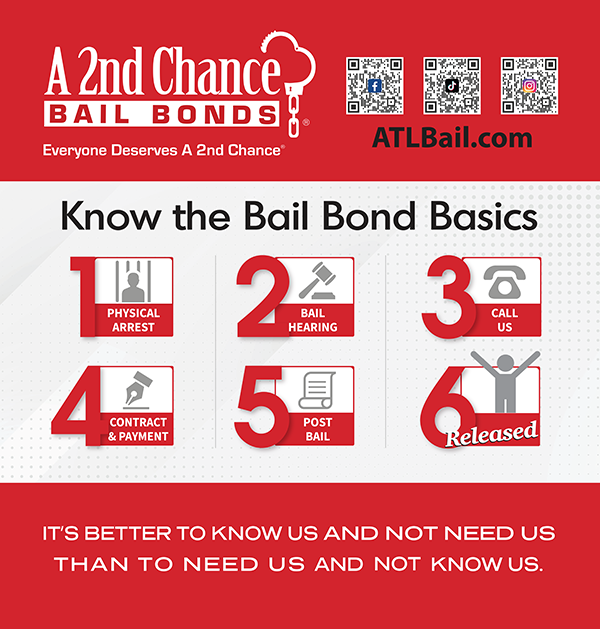

When someone is arrested, they often find themselves navigating the complex world of bail bonds. A bail bond is essentially a contractual agreement between a defendant, a bail bondsman, and the court, allowing the defendant to be released from custody while awaiting trial.

The bail amount is set by a judge, reflecting the severity of the charges and the risk of flight. Typically, a bail bondsman charges a non-refundable premium, usually around 10% of the total bail amount, to secure the bond.

This fee is paid upfront, and the bondsman assumes the financial risk, ensuring the court that the defendant will appear for all scheduled hearings. Understanding these fundamentals is crucial for families seeking affordable options during difficult times.

Assessing your financial situation is a critical step in determining the most suitable approach to securing a bail bond. Start by calculating your total income, including any part-time jobs, benefits, or alternative sources of revenue.

Next, list your essential expenses such as housing, utilities, groceries, and transportation. This will help you identify your disposable income, which is crucial when deciding how much you can afford to allocate towards a bail bond.

Additionally, consider any savings or assets that could be utilized, as well as potential support from family or friends. By gaining a comprehensive understanding of your financial landscape, you can make informed decisions that align with your needs and circumstances when seeking a bail bond.

Navigating the landscape of bail bond companies requires careful consideration and thorough research. Begin by seeking recommendations from trusted sources, such as friends, family, or legal professionals. Online reviews and testimonials can also provide insight into the reputation and reliability of a company.

Verify that the bail bond agency is licensed and operates within your state's regulations. Additionally, investigate the experience of the agents; those with extensive knowledge can offer valuable guidance throughout the process.

Pay attention to the level of customer service provided, as this can significantly impact your experience. Finally, ensure that the company is transparent about their procedures and maintains open communication, fostering a sense of trust during a challenging time.

Comparing rates and fees among bail bond companies is crucial for ensuring that you receive the best value for your financial commitment. Bail bond fees typically range from 10% to 15% of the total bail amount, but this can vary significantly by jurisdiction and company.

Additionally, consider any hidden costs, such as processing fees or collateral requirements, that may impact the overall expense.

Request detailed quotes from multiple providers and inquire about their terms and conditions. A reputable company will be transparent about its fees and willing to explain the breakdown. By thoroughly comparing these rates, you can make an informed decision that minimizes financial strain while securing the necessary support for your loved one.

When it comes to securing a bail bond, understanding the various payment options available is essential for managing your financial obligations effectively. Most bail bond companies offer a range of payment plans, including cash, credit cards, and financing options.

Cash payments are often the simplest and quickest method, while credit card payments may incur additional fees. Some agencies also provide flexible financing plans, allowing families to pay the premium over time, which can ease the financial burden.

Additionally, inquire about any potential discounts for upfront payments or referrals. It is crucial to read the terms carefully, ensuring you understand any interest rates or hidden fees associated with financing options, to make an informed decision that aligns with your financial situation.

Securing a bail bond is often just one step in a more complex legal process. Once a loved one is released from custody, it is crucial to seek legal assistance to navigate the ensuing legal challenges. An experienced attorney can provide invaluable guidance, helping families understand the charges, potential consequences, and options available.

Legal counsel can also assist in negotiating plea deals, preparing for court appearances, and ensuring that rights are protected throughout the process.

Families should prioritize finding a lawyer with expertise in criminal defense, as this can significantly impact the outcome of the case. Additionally, some legal aid organizations offer pro bono services, which can alleviate financial burdens during this challenging time.

Bail bondsmen typically operate 24/7 to accommodate individuals who require their services at any time, especially during emergencies involving arrests. This availability ensures that defendants can secure their release promptly after an arrest, facilitating their participation in upcoming court proceedings. However, it is advisable to confirm the operating hours of specific bail bond agencies, as some may have varying schedules or limited availability during certain holidays or circumstances.

Yes, there are alternatives to using a bail bond service. Defendants may consider cash bail, where the full bail amount is paid upfront to the court. Alternatively, some jurisdictions offer pretrial release programs, which assess a defendant's risk and may allow for release without bail. Additionally, property bonds can be utilized, where real estate is collateralized. It is advisable to consult with legal counsel to explore the most suitable option based on individual circumstances.

Yes, you can use collateral other than cash for a bail bond. Common forms of collateral include real estate, vehicles, jewelry, and other valuable assets. The bail bond agent will typically assess the value of the collateral to determine its adequacy in securing the bond. It is essential to understand the terms and conditions associated with collateral agreements, as failure to meet the obligations could result in the forfeiture of the pledged assets.